|

|

|

|

|

|

1880 - Pico Oil Spring Mine Section 2 patented by R.F. Baker and Edward F. Beale [ story]

|

The Master's University men's golf team shot a 13-under 275 to finish second at the Golden State Athletic Conference Men's Golf Championships held at Briarwood Country Club in Sun City West, Ariz.

|

Join local nonprofit Project Sebastian for an exhilarating day of racing and community support at its Rare Warrior 24 race on Saturday, June 1, at Heritage Park in the heart of Santa Clarita.

|

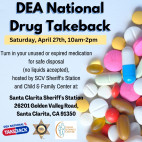

Santa Clarita Valley Sheriff's Station Station deputies will be taking part in the “DEA National Drug Take Back Day,” Saturday, April 27, from 10 a.m. to 2 p.m., in front of the SCV Sheriff’s Station, located at 26201 Golden Valley Road.

|

The College of the Canyons Center for Civic and Community Engagement—in collaboration with COC’s Golden Z Club—invites the community to attend the Nonprofit Community Resource Fair on Tuesday, April 30.

|

College of the Canyons made quick work of visiting L.A. Valley College in a shortened 11-3 home victory that came on a day in which the program unveiled its newly named Michele Jenkins Softball Team Room during a pre-game dedication ceremony.

|

For aspiring scientists at The Master’s University, taking up a student research project is no small commitment.

|

The Los Angeles County Department of Public Health is warning residents not to use a Vietnamese herbal ointment called “Cao Bôi Trĩ Cây Thầu Dầu” (Castor Oil Hemorrhoid Extract) because it contains lead and can be fatal.

|

State Superintendent of Public Instruction Tony Thurmond hosted a California Apprenticeship Summit Wednesday to raise awareness of apprenticeship opportunities and career technical education pathways that connect California’s youth to high-wage, high-growth career opportunities.

|

College of the Canyons student-athletes Nichole Muro (softball) and Angelo Aleman (baseball) have been named the COC Athletic Department's Women's and Men's Student-Athletes of the Week for the period running April 8-13.

|

California State Sen. Scott Wilk, R-Santa Clarita, announced Wednesday his bill improving transparency between parents and schools’ sexual education curricula passed out of the Senate Education Committee.

|

1945 - Actors Harry & Olive Carey sell Saugus ranch after 29 years; now Tesoro del Valle [ story]

|

The 76.6-mile-long Antelope Valley Line has the third-highest ridership in Metrolink’s system with an estimated average of 9,000 passengers daily. However, the uneven terrain and single-tracking along the line in some areas forces trains to travel at a slower speed which results in an estimated travel time of approximately one hour between Santa Clarita and Union Station.

|

Team Dragon Eyes, affectionately known as TDE, is gearing up to host its highly anticipated Fifth Annual Dragonboat Festival race on Saturday, June 1 at Castaic Lake, Lower Lagoon.

|

This year marks the 20th year that the city of Santa Clarita has been hosting the annual Bike to Work Challenge. The community is invited to celebrate by riding a bike to work the week of May 13, and stopping by a pit stop on Thursday, May 16.

|

Ready to take control of your financial future? Join the Los Angeles County Department of Consumer and Business Affairs Center for Financial Empowerment for the next installment in the Lunch & Learn Financial Capability Month webinar series, "Understanding Credit.

|

The Santa Clarita Valley Concert Band will perform a "Starry Might" concert at 7 p.m. on Saturday May 4. The concert, under the direction of Tim Durand, will be held at the Canyon Theatre Guild, 24242 Main St., Newhall, CA 91321.

|

After a record-setting 2023 combatting organized retail crime, the California Highway Patrol continues to aggressively disrupt and dismantle illegal operations throughout California.

|

Celebrate Earth Day on Monday, April 22 with California State Parks at any of the 280 unique park units across the state. State Parks has numerous Earth Day-themed events planned. They include in-person activities such as guided walks and hikes, workdays and a bioblitz, as well as virtual programming with a live dive broadcast exploring the hidden world of the ocean.

|

1930 - Telephone switchboard operator Louise Gipe, heroine of the 1928 St. Francis Dam disaster, tries & fails to kill herself over an unrequited love [ story]

|

Los Angeles County Sheriff Department’s Major Crimes Bureau Detectives worked closely with Century Station Detectives after learning of a serial robbery crew committing crimes throughout Los Angeles County.

|

Join the Samuel Dixon Family Health Center for their second annual Cornhole Tournament fundraiser where all proceeds will support mental health services to anyone in need.

|

California State University, Northridge will confer honorary doctorates on four alumni, all respected leaders in their fields, at the university’s commencement ceremonies next month.

|

On Saturday, April 20, 2024 Valencia High School Theatre will host the 104th DTASC (Drama Teachers’ Association of Southern California) Shakespeare Festival.

|

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.