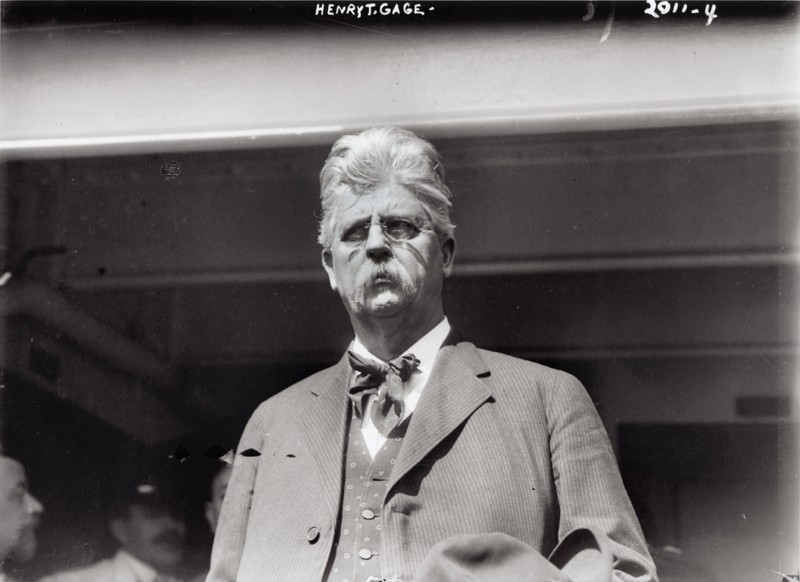

Sen. Dianne Feinstein, D-Calif.

[Sen. Feinstein] – Alarmed by the recent spike in gas prices, as well as shortages at California gas stations, U.S. Sen. Dianne Feinstein, D-Calif., sent a second letter Monday to Jon Leibowitz, chairman of the Federal Trade Commission, asking for an immediate investigation to protect California’s consumers.

“California commuters are facing the highest gas prices and the longest commutes in the country,” Feinstein said. “Paying hundreds of dollars to fill your tank every time you go to the pump is untenable, particularly because it does not appear the price spike and supply disruption are related to supply and demand.”

In her letter, Feinstein added: “California’s consumers are all too familiar with energy price spikes which cannot be explained by market fundamentals, and which turn out years later to have been the result of malicious and manipulative trading activity. It is with this history in mind that I call on the FTC to act immediately and aggressively to protect California’s consumers.”

Full text of the letter follows:

October 7, 2012

The Honorable Jon Leibowitz

Chairman

Federal Trade Commission

600 Pennsylvania Avenue, NW

Washington, DC 20580

Dear Chairman Leibowitz:

I am writing to express my deep concern that the Federal Trade Commission (FTC) is failing to take action to protect California consumers from malicious trading schemes in the California gasoline market.

In order to uphold the FTC’s consumer protection mandate, I ask the Commission to open an immediate investigation into price spikes in California, to begin collecting relevant data on California’s gasoline markets, and to establish a permanent market monitoring team. In 2007, Congress gave the FTC unique authority to investigate and prevent any manipulative or deceptive device or contrivance that could be resulting in unjustifiably high gasoline prices. I believe the FTC can only uphold this mandate by actively monitoring markets and investigating unusual behavior.

First, I request that the FTC immediately initiate an investigation to determine if the price spike in Southern California this week results from an illegal short squeeze. A Reuters investigation cites industry sources who believe that the 97-cent price spike in CARBOB gasoline this past week “has many of the hallmarks of a classic short squeeze.” Multiple trade sources say Tesoro Corporation was caught short on supply. In the severely concentrated Los Angeles gasoline market, the few sellers were reportedly able to squeeze Tesoro either through collusion or use of market power. An FTC investigation is likely the only way to determine whether this reported squeeze took place.

Publically available data appears to confirm that market fundamentals are not to blame for rising gas prices in California. Despite a pipeline and refinery shut down, gasoline production in the state last week was almost as high as a year ago, and stockpiles of gasoline and blending components combined were equal to this time last year, state data show.

Second, I ask that the FTC immediately seek data sharing agreements that will allow it to monitor gasoline and oil markets actively and effectively. Data on prices, trading activity, refinery output, demand, stocks, and other information are vital to determine if trading activities reflect fraud, manipulation, or other malicious trading practices. While much of this data is currently collected, but not released, by the CFTC, the Energy Information Administration, the California Energy Commission, and private sources, the FTC does not collect, compile, or analyze this information in any organized or ongoing way. I believe that obtaining relevant data is a basic prerequisite of effective consumer protection.

Third, I request that the FTC establish a permanent gasoline and oil market oversight unit modeled on the Federal Energy Regulatory Commission’s (FERC) Division of Energy Market Analytics and Surveillance. As you know, FERC’s anti-manipulation authority in natural gas and electricity markets mirrors the FTC oil market authority nearly word for word. With its authority, FERC has built an entire division of market monitoring professionals who oversee trading in real time to protect consumers from malicious trading practices. I fail to understand why the FTC has not yet set up its own unit to oversee oil markets.

California’s consumers are all too familiar with energy price spikes which cannot be explained by market fundamentals, and which turn out years later to have been the result of malicious and manipulative trading activity. In order to prevent such abuse from occurring again, Congress has spent more than ten years building up the market oversight authorities of the CFTC, the FTC and the FERC. However, our efforts depend on aggressive and serious enforcement within the Commissions.

It is with this history in mind that I call on the FTC to act immediately and aggressively to protect California’s consumers. I look forward to your prompt response and action.

Sincerely,

Dianne Feinstein

United States Senator

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

1 Comment

This only took how many years of gas price manipulation for a politician to do something? Now the next question will be,”How many politicians do the gas and oil lobbyists already own and will it protect the people or the gas and oil companies?