Assembly Bill 2663, which extends property tax relief to registered domestic partners who were previously denied equal treatment, is among the dozens of bills passed by the state legislature and recently signed by Governor Jerry Brown.

AB 2663 was sponsored by Los Angeles County Assessor Jeff Prang and carried by Assemblymember Laura Friedman (D-Glendale). It passed in both chambers of the state Legislature with bipartisan support and no opposition.

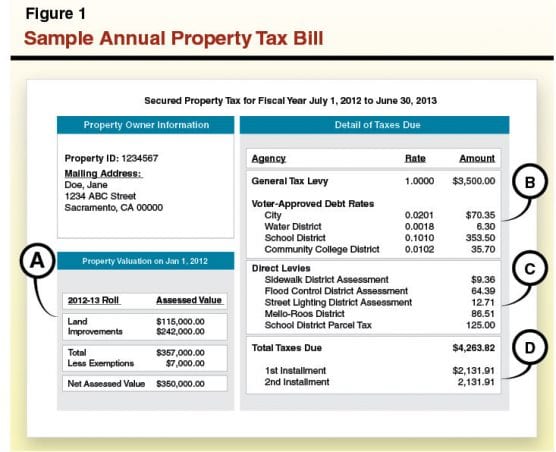

AB 2663 provides access to the “interspousal exclusion,” which permits the transfer of real estate between spouses without triggering a re-assessment under Proposition 13 that could prompt significantly higher property taxes. This is of particular importance in cases where one spouse has died and the surviving spouse inherits their family home.

“My first priority as Assessor is to ensure fair treatment in the property tax system,” Prang said in a statement. “When a constituent who had been personally affected by this inequity in the law approached my office, it was immediately clear to me that we needed to take action. I am grateful to Assemblymember Laura Friedman for shepherding this important bill through the Legislature, and to Equality California for their tireless advocacy.”

The incremental march toward marriage equality entailed many local jurisdictions in California adopting domestic partner registries, followed in 1999 by the creation of a state registry – the first of its kind in the US enacted without court intervention.

However, not all domestic partners who previously registered at the local level re-registered with the state; these families were not included as the tax relief benefit was expanded in 2006 to domestic partners registered with the state. AB 2663 remedies this disparity.

“No one should be at risk of losing their home as a result of the death of a partner. AB 2663 closes an unintended loophole and ensures that all couples have equal access to benefits, including tax relief,” said Friedman, who represents the 43rd District.

“For too long, some registered domestic partners have unfairly paid more in property taxes due to the death of a partner,” said Equality California executive director Rick Zbur. “We are grateful for Assemblymember Friedman’s and Assessor Prang’s leadership on correcting this injustice.”

Couples who registered locally from Jan. 1, 2000 to June 26, 2015 will be able to file with their respective county assessors’ offices for re-assessment reversal so that future tax bills reflect the original base values, lowering the tax burdens. These applications will be available soon and must be received by assessors no later than June 30, 2022.

For additional information on the new law, or to obtain the needed forms, contact the L.A. County Assessor’s Office at 213-974-3101 or pio@assessor.lacounty.gov.

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.