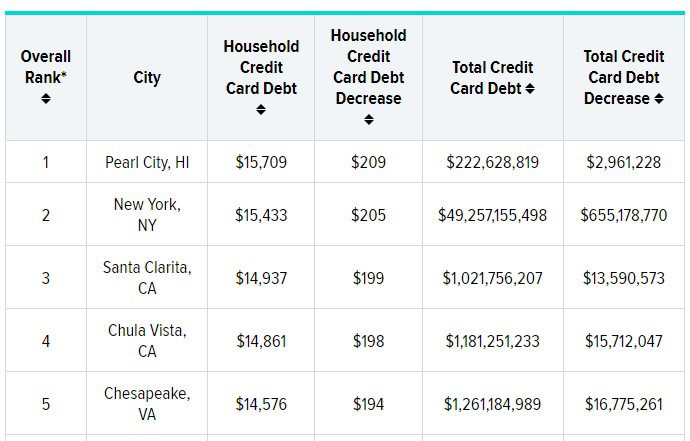

WalletHub recently released their study on credit card debt, and found Santa Clarita ranked third among all surveyed for paying down its credit card debt.

WalletHub’s Credit Card Debt Study found that consumers paid down $13.2 billion in credit card debt during Q1 2022 (76% less than last year). In addition, WalletHub’s Fed Rate Hike Report revealed that a Federal Reserve interest rate increase on June 15 would cost people with credit card debt an extra $3.2 billion in the next year alone.

Please find key takeaways from the studies and accompanying consumer surveys below. You can also check out commentary from WalletHub experts (audio and video files included).

Credit Card Debt in Santa Clarita:

-Q1 2022 Change in Household Debt: – $199

-Average Household Debt: $14,937

-Q1 2022 Total Change in Debt: – $13,590,573

-Total Outstanding Debt: $1,021,756,207

Credit Card Debt Study Key Stats

-Debt Reduction. Consumers paid off $13.2 billion in credit card debt during Q1 2022, which is 76% less than the same period last year.

-Higher Average Household. The average household credit card balance was $8,425 in Q1 2022, 11.9% higher than in Q1 2021.

-Average Annual Increase. The average annual increase in credit card debt over the past 10 years is just $49.7 billion.

-Best Balance Transfer Credit Cards. The best balance transfer credit cards currently offer 0% APRs for the first 15-21 months with no annual fee and low balance transfer fees.

Fed Rate Hike Survey Key Findings

-More Costly Debt. A Federal Reserve interest rate increase on June 15 would cost people with credit card debt an extra $3.2 billion in the next year alone. That’s on top of the $4.9 billion increase already caused by the Fed’s previous rates hikes this year.

-Consumers Not Happy About Rate Hikes. 72 million Americans are upset about the Fed raising interest rates.

-Inflation Concerns. 89% of Americans are concerned about inflation right now.

-Heading for a Recession. 8 in 10 Americans think we are heading into a recession.

-More Worry Over Inflation Than High Rates. 76% of Americans are more worried about high inflation than high interest rates.

-People Spending Less Due to Rate Increases. About 1 in 2 people (49%) want to spend less money due to this year’s Fed rate increases.

More info click here.

Please let me know if you have any questions or if you would like to arrange a phone, Skype or in-studio interview with one of WalletHub’s experts. WalletHub commentary also is included below in text, audio and video formats. Feel free to embed the YouTube video or edit the raw audio and video files as you see fit.

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.