The median price of single-family homes that closed escrow during April was $555,000, up 3.1 percent from April 2017 and 3.7 percent higher than March.

Since the Great Recession, the home median price peak of $560,000 arrived in July and repeated again in January. Nonetheless, the April home median price was 13.7 percent below the record high of $643,000 set in April 2006.

Similarly, the highest condominium median price reported since economic recovery started was $372,000 in September, though this April’s median of $365,000 came the closest to that high point. The all-time record high condo price of $397,000 was set in January 2006.

After soaring high for the first three months of the year, condominium sales in the Santa Clarita Valley fell back to earth during April, the Southland Regional Association of REALTORS® reported today.

A total of 81 condominiums changed owners last month, down 31.4 percent from the 118 closed condo escrows of April 2016, which was the highest monthly total last year.

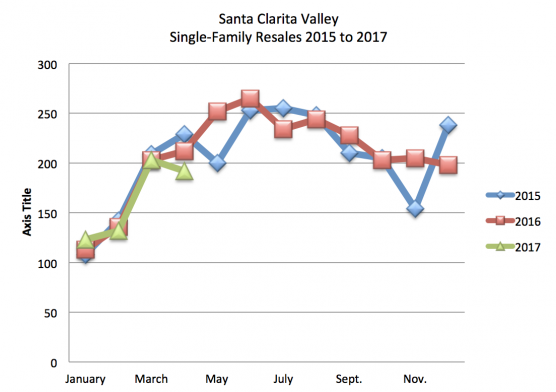

REALTORS® also helped closed escrow on 192 single-family homes, down 9.4 percent from April 2016 and 5.4 percent lower than this March.

“Condominium sales had to start falling eventually,” said Martin “Marty” Kovacs, chairman of the Santa Clarita Valley Division of the Southland Regional Association of Realtors.

He noted that condo sales for the first three months — totaling 263 closed escrows — were the highest since the first three months of 2007 when 274 condos changed owners. The record high for the first trimester of any year came in 2005 with 410 condo closed escrows.

“Perhaps changes by the FHA last year that relaxed owner occupancy rules in some condominium developments, from 50 percent to as low as 35 percent, contributed to a short-term surge,” he said.

“No doubt rising prices impact sales, but the more dramatic limitation comes from the extremely tight inventory of homes and condos listed for sale,” said Tim Johnson, the Association’s chief executive officer. “There simply are not enough properties available to meet normal demand, which would ease pressure on prices and reduce the number of multiple offers.”

REALTORS® reported a total of 479 active listings at the end of April. That was off 5.5 percent from a year ago, but up from the 414-listing tally of this March.

At the current pace of sales, April’s 479 listings represented a 1.8-month supply, marking the third consecutive month listings were below a 2.0-month inventory. A 6-month supply once was thought to represent a “normal” market, but that large of an inventory has not been seen since 2011.

Of the 273 homes and condos sold last month, 263 or 96.3 percent were standard sales involving traditional buyers and sellers. REALTORS® reported only three foreclosure related sales, for a 1.1 percent share of the market, and four short payoffs, for a 1.5 percent share.

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.