By Nick Rummell

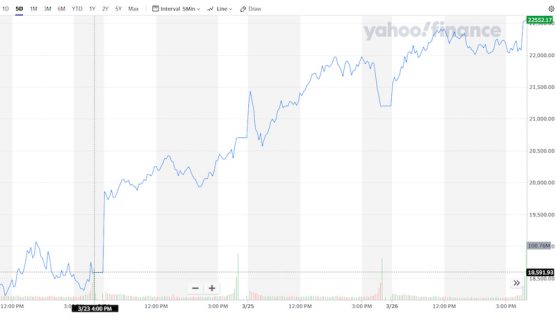

MANHATTAN (CN) — Unfazed by historic unemployment numbers, Wall Street built on its rally for the third straight day.

A tepid morning resulted in a huge 6% gain across the board, with the Dow Jones Industrial Average closing about 20% higher than when it opened on Tuesday.

An hour before the morning bell Thursday, the Department of Labor announced that jobless claims rose from 3,001,000 to 3,283,000 for the week ending March 21, nearly a 120% increase and the highest recorded since the department began during the 1960s.

Department of Labor personnel turn New Yorkers away at the door in this March 18, 2020, file photo. (AP Photo/John Minchillo)

The jobless numbers eclipse the previous high of 695,000 unemployment claims in 1982. They are about five times as high as the unemployment peak during the Great Recession of 2009, which saw 665,000 claims.

Investors were undeterred by the bad news, with the Dow opening to an increase of 2%, while the S&P 500 and Nasdaq followed closely behind.

The Dow added well over 1,300 points Thursday and now sits at roughly the same point as on March 12.

In Europe, most markets reversed losses earlier in the day to close at least a one to two points higher. The Stoxx 600 closed 2.55% up for the day.

Administration officials were quick to downplay the unemployment numbers. Labor Department Secretary Eugene Scalia said the rise in claims “was not unexpected” and noted the stimulus bill accounted for high unemployment.

After previously warning of unemployment as high as 20% due to coronavirus, Treasury Secretary Stephen Mnuchin waved off the record-setting amount of unemployment claims today in a call with CNBC.

“I just think these numbers right now are not relevant,” said Mnuchin, who also praised the stimulus as a fix to the unemployment problem. “Small businesses hopefully will be able to hire back a lot of those people. Last week, they didn’t know if they had protections, they didn’t have any cash, they had no choice.”

Market gains have largely been attributed to the stimulus package. After news broke Tuesday that senators had finally hammered out a deal on advancing a third stimulus package, the markets enjoyed a historic rally.

U.S. markets have now closed above their starting point for three consecutive days.

The 883-page stimulus bill, the largest government aid package in U.S. history, passed the Senate 96-0 late Wednesday. It now moves to a vote in the House, expected Friday.

Unemployment insurance had been a last-minute sticking point, with four Republican senators worried the bill could actually incentivize workers not to return to their jobs.

In the bill passed by the Senate, unemployment insurance would be extended by 13 weeks and boosted by an additional $600 per week. Part-time workers and the self-employed would also be covered by some of the new unemployment benefits.

Ten states saw a least 100,000 higher unemployment claims than the previous week, according to the data. By far the hardest hit so far on the labor side, Pennsylvania saw a 363,000 increase in claims. Utah saw the fewest new claims, with only nine filed last week.

New York, where coronavirus diagnoses in the country are highest, saw only a “moderate” increase of 66,000 claims but that number is likely to rise in the coming weeks.

More fiscal and monetary policy moves may be on the way.

In an interview on NBC Thursday morning, Federal Reserve Chairman Jerome Powell said the central bank is “not going to run out of ammunition” and that it has “policy room in other dimensions to support the economy.”

The Fed has already slashed its interest rates nearly to zero. In another historic move, the central bank earlier this week announced moves to offer open-ended borrowing “as needed” to free up liquidity. The central bank also promised to soon open a lending program for small- and medium-sized businesses.

Cases of Covid-19, the new strain of coronavirus, have more than doubled in the last week, according to data compiled by Johns Hopkins University.

The virus has affected more than 521,000 and killed more than 23,000 worldwide. In the United States, which the World Health Organization has warned could become the next epicenter for the coronavirus pandemic, nearly 80,000 are confirmed infected while about 1,000 have died from the virus.

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.