MANHATTAN — Wall Street recovered more losses from the coronavirus pandemic Monday, adding to last week’s historic upswing, though the volatility — and losses — are not likely over.

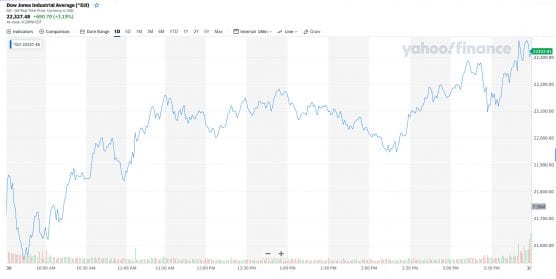

The Dow Jones Industrial Average closed about 700 points higher — a 3.1% increase — after a mild opening at the morning bell. The S&P 500 and Nasdaq had even bigger percentage jumps, closing 3.3% and 3.6% higher, respectively.

Leading investment firms have cautioned against too much optimism, however, as the exact mortality and economic ramifications of the Covid-19 pandemic remain in flux.

In an investor note issued Monday, UBS warned that “because infection rates are likely to keep rising for some time, and also because in-cash equity markets we have not yet seen a capitulation in the core positions in growth style stocks, it may be early to say a firm bottom has already been made.”

Similar warnings were issued by analysts at Goldman Sachs, who said: “We believe it is likely that the market will turn lower in the coming weeks, and caution investors against chasing this rally.”

The Dow reached its lowest point during the coronavirus on March 23, when it closed at 18,591 points. Five days later, President Trump signed into law a $2.2 trillion stimulus package to help shuttered businesses maintain payroll and ease economic burdens for furloughed or laid-off employees.

The president has said further measures may be warranted — and taken — to prop up the economy. Reportedly the House is already considering a Phase IV stimulus. The House and Senate are in recess until April 20.

European markets initially fell but closed on a positive note. The pan-European market Stoxx 600, which was down more than 2% earlier in the day, closed up 1.2%. Markets in Germany and the United Kingdom also rose 2% and 1%, respectively.

Oil markets also continue to be shaken by the social-distancing guidelines, which has kept drivers at home. Oil prices hit new lows Monday, with the West Texas Intermediate dipping below $20 per barrel, its lowest price in nearly two decades.

Oil companies have lamented the massive drop in demand brought about by social distancing, with some investors calling the current environment a “bloodbath.”

President Trump spoke recently about reopening the economy by Easter, only to announce Sunday at his daily press briefer that he would extend social-distancing guidelines through April 30.

“It was just an aspiration,” Trump said of his initial Easter deadline. “Easter should be the peak number, and it should start coming down and hopefully very substantially from that point.”

The decision was prompted, at least in part, on new estimates from the administration’s leading infectious-disease experts that as many as 200,000 Americans could die from Covid-19.

More than half of all states have statewide stay-at-home orders on nonessential business. Maryland and Virginia issued statewide stay-at-home orders Monday, while Florida announced it would shut down only parts of its state.

Cases of Covid-19, the new strain of coronavirus, have more than doubled in the last week, according to data compiled by Johns Hopkins University. The virus has affected more than 766,000 and killed nearly 37,000 worldwide.

Last Thursday, the United States surpassed Italy and China to take the lead in the number of Covid-19 cases. About 153,000 have been infected by the virus in the United States, while 2,800 have died.

— By Nick Rummell, CNS

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.