The City Council will hold a public hearing Tuesday on the creation of a facilities district to pay for three parking structures and a new Metrolink station.

The following it the staff report for the public hearing:

RECOMMENDED ACTION

City Council:

1. Conduct a public hearing on the a) formation of Community Facilities District No. 2016-1 (Vista Canyon), b) levy of special taxes, and c) issuance of special tax bonds secured by the special taxes.

2. If no majority protest exists at the public hearing, adopt a resolution determining the validity of prior proceedings, establishing the Community Facilities District No. 2016-1 (Vista Canyon), and approving a funding and acquisition agreement.

3. Adopt a resolution determining the necessity to incur bonded indebtedness within Community Facilities District No. 2016-1 (Vista Canyon) and calling a special election.

4. Open and review ballots, and if the proposition passes with a 2/3 vote, adopt a resolution canvassing the results of the election held within Community Facilities District No. 2016-1 (Vista Canyon).

5. Introduce and pass to second reading an ordinance entitled, “AN ORDINANCE OF THE CITY COUNCIL OF THE CITY OF SANTA CLARITA, ACTING AS THE LEGISLATIVE BODY OF THE CITY OF SANTA CLARITA COMMUNITY FACILITIES DISTRICT NO. 2016-1 (VISTA CANYON), AUTHORIZING THE LEVY OF SPECIAL TAXES.”

BACKGROUND

The Vista Canyon project was approved by City Council on April 26, 2011. Resolution No. 11-23 was also approved by City Council on April 26, 2011, that included the Final Conditions of Approval and the Transit Funding Agreement that contemplated the creation of a community facilities district over the commercial properties within the Vista Canyon project and required Vista Canyon’s commitment to allocate 15% of the net construction proceeds of the CFD bonds to the construction of the Transit Station.

Community facilities districts are a form of financing district that can be used by cities, counties, school districts, and special districts. A district has the authority to levy a special tax to finance a variety of public improvements or services. If there are more than 12 eligible voters, the special tax must be approved by a two-thirds vote of the registered voters within the district; otherwise, the property owners can vote to approve the special tax. A community facilities district can be formed to finance a wide list of improvements, which include roads, parking facilities, water facilities, sewers, and schools. They are also used to finance ongoing maintenance services of the facilities or for services such as landscaping, streets, and lighting and drainage facilities. The taxes are secured by a continuing lien and levied against benefitting property within the district on an annual basis. The revenue stream is used to pay debt service on bonds, finance facilities on a pay-as-you-go basis, and to pay for services, or a combination thereof.

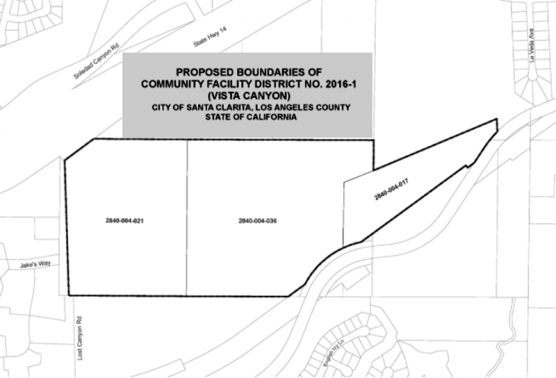

The City received a Petition (including consent and waiver) to form a community facilities district with respect to the Vista Canyon development from Vista Canyon Ranch, LLC and Vista Canyon Phase I, LLC, who are the owners of the property in the proposed development (collectively, Owner). Located at the end of Lost Canyon Road near Sand Canyon, the approved Vista Canyon development will include up to 1,100 dwelling units (apartments, townhomes, and detached single family), as well as 950,000 square feet of commercial uses (office, retail, restaurants, hotel(s) and a theater). Land development is underway, and the applicant is moving forward on the initial phase of the project. Phase 1 includes apartments, the first office/retail building, and the first parking structure.

The Owner requested that the City move forward and declare its intent to form a community facilities district designated as “City of Santa Clarita Community Facilities District No. 2016-1 (Vista Canyon)” (the “CFD”), and issue bonds secured by special taxes within the CFD to fund up to three parking structures and a portion of the approved Transit Station, totaling up to $45 million (the “Project”). Fifteen percent (15%) of net construction proceeds of each bond issue will be set aside for the Vista Canyon Transit Station.

On February 23, 2016, the City Council declared its intention to form the new CFD and issue bonds and called a public hearing for April 12, 2016, on all matters relating to the CFD including the special tax formula or the Rate and Method of Apportionment (RMA). Under the RMA, parcels for apartments and commercial use will be subject to the special tax. Parcels for

single- and multi-family (for-sale) residential units are not subject to the CFD tax.

Provided there is no majority protest at the public hearing, a) the CFD may be formed and funding and acquisition agreement with the Owner may be approved, and b) an election may be called. The funding and acquisition agreement provides for the method and terms for the CFD to acquire completed parking facilities from the Owner using the future bond proceeds.

A waiver regarding election time limits was received from the Owner, so a special election can be called for this evening to authorize a) the levy of special taxes, b) the issuance of special tax bonds not to exceed $45 million, and c) an appropriations limit for the CFD. Should the proposition pass with a two-thirds vote from the qualified voters (the Owner), the City Council may conduct the first reading of an Ordinance levying the special tax. The second reading and adoption of the Ordinance is scheduled for the next City Council meeting on April 26, 2016.

Once the CFD is formed and the election concluded, it is the intent of the CFD to issue two or more series of bonds secured by special taxes relating to the facilities within the CFD when market conditions allow. Currently, it is not expected that bonds will be authorized for issuance or sale until the Project construction is well underway and the first parking structure is at or near completion, at which time documents relating to the issuance and sale of the bonds will be brought to the Council for its approval. This is not expected to occur until April of 2017.

The CFD is comprised of two tax zones. The financing meets or will meet (at the time of issuance if a waiver is not requested) all City policies and procedures with respect to financing the parking structure and transit station. The only exception to the City’s Public Financing Policy will be that the proposed financing provides for bond debt service and special taxes to increase at 2% per year through the proposed 30-year term of any series of bonds. Staff is recommending an exception to the Policy, since there will be no single and multi-family (for- sale) residential taxpayers.

The City in its sole discretion will determine the final amount of bonds issued. The proposed maximum bond authorization is $45,000,000. The “not to exceed” bond amount for the CFD is based on Project costs and available special taxes and has been reviewed by the City Financial Advisor. The facilities and services proposed to be financed and the RMA of the special tax proposed to be levied, as well as the proposed boundaries of the CFD, are described on the exhibits to the resolution of formation. It is the intent to have the property owner association pay for ongoing maintenance and operation of the parking structure. An annual special tax for such services is included in the CFD and would only be implemented in the unlikely event the association did not cover these costs.

Harris & Associates, as special tax consultant for the City, has prepared a CFD Report describing the proposed CFD.

Although the City of Santa Clarita forms the CFD, the debt issuances are not obligations of the City, but rather obligations of the CFD. Therefore, the formation of the CFD does not obligate the City to make any expenditure or proceed with the project or obligate the City or the CFD to issue any bonds. Finally, the finances and bonds of the CFD are unrelated to, do not rely upon, and do not impact the credit rating of the City.

FISCAL IMPACT

There is no impact to the City General Fund. All expenses associated with the creation of the CFD will be provided by the developer deposit and bond proceeds.

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

2 Comments

When did apartments become part of this development?

Let the City Council’s cronies pay for it. No new tax!