The Los Angeles County Treasurer and Tax Collector is in the process of mailing Notices of Delinquency to property owners who have not paid their Annual and/or Supplemental Secured Property Taxes in full for the 2022-23 tax year.

Delinquent taxes from the 2022-23 tax year will default if payment is not received or United States Postal Service postmarked by Friday, June 30, 2023.

On Saturday, July 1, 2023, the agency will impose a $15 redemption fee and additional penalties of 1.5 percent per month on the defaulted taxes. If residential or agricultural property remains tax defaulted for more than five years or commercial property or unimproved vacant residential lots for more than three years, they will sell the property at a public auction in accordance with State law.

As a result of this mailing, property owners may find it difficult to reach the county treasurer on the telephone. Owners may obtain answers to the great majority of their questions, including how to request a copy of a property tax bill, obtain the amount due on any property or find the tax payment history for the past three fiscal tax years on the Los Angeles County Property Tax Portal. Property owners may also submit their inquiries on the online portal or call the toll‑free Property Tax Information Line at 1(888) 807-2111, where automated information is available 24 hours a day, seven days a week.

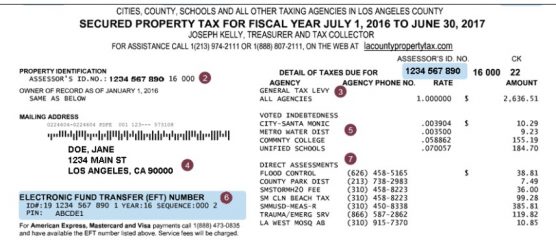

The agency recommends property owners pay their property taxes online. Electronic check payments are easy, available at no cost, and only require bank routing and checking account information and the Personal Identification Number (PIN) for the property. The PIN is on the Annual Secured Property Tax Bill or on any original property tax bill from a prior year.

Third Party Notification Program

Property owners can designate a third party (e.g., a friend, family member or agency) to receive a copy of past due notices. While third parties are not responsible for paying the property tax bill, they can remind property owners that their property taxes may be in default, or remind them to take action to prevent them from losing their property in the event of a tax sale. Senior citizens, those with language limitations, and others who require special assistance are among those who may benefit from this program. To enroll in this program, please visit the website.

Owners may contact the agency online or by phone at 1(888) 807-2111, between 8 a.m. and 5 p.m. Monday through Friday, excluding Los Angeles County holidays. Anyone who is hearing impaired and has TDD equipment may leave a message at 1(213) 974-2196 or use California Relay Services at 1(800) 735-2929.

It is recommended to check the email SPAM folder for emails and to add the @subscriptions.lacounty.gov domain name to Safe Senders List to ensure emails are received in the future.

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.