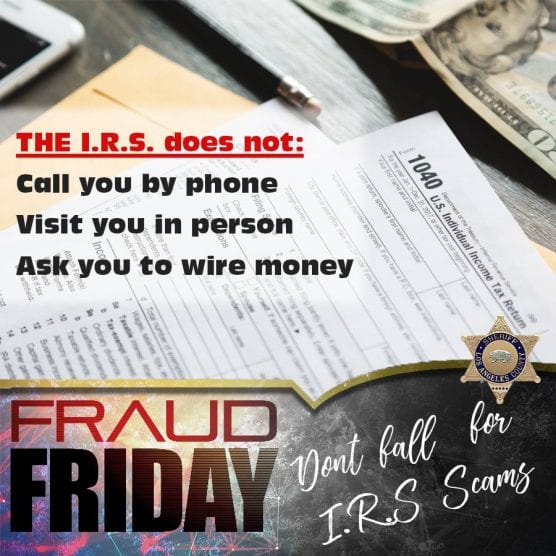

The Los Angeles County Sheriff’s Department’s “Fraud Friday” focus this week is on phone scammers claiming to be officials from the Internal Revenue Service, which only uses U.S. Postal Service mail.

Here’s the feature:

“Throughout the years, many taxpayers have encountered individuals impersonating Internal Revenue Service officials, whether it be in person, over the telephone or via email. Don’t fall victim to this scam.

“The LASD and the IRS want you to understand how and when the IRS contacts taxpayers and help you determine whether indeed the contact is from an IRS employee.

“The IRS contacts taxpayers through regular mail delivered by the United States Postal Service.

“Scams take many shapes and forms, such as phone calls, letters and emails. Many IRS impersonators use threats to intimidate and bully people into paying a fabricated tax bill. They may even threaten to arrest or deport their would-be victim if the victim doesn’t comply.

“Here are some methods used by scammers provided by the IRS to protect you and your family:

• Scammers will call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail a bill to any taxpayer who owes taxes.

• They will demand that you pay taxes without the opportunity to question or appeal the amount they say you owe. You should also be advised of your rights as a taxpayer.

• Some may threaten to bring in local police, immigration officers or other law-enforcement to have you arrested for not paying.

“NOTE: The IRS also cannot revoke your driver’s license, business licenses, or immigration status. Threats like these are common tactics scam artists use to trick victims into buying into their schemes.

“Final thought: Never give out any personal information if a scammer requests it. An official IRS employee will already have your information.

“If you are a taxpayer and have questions, you should contact the International Taxpayer Service Call Center by phone or fax.

“The International Call Center is open Monday through Friday from 6 a.m. to 11 p.m. (Eastern Time). Phone 267-941-1000 (not toll-free) or fax 267-466-1055 (for international tax account issues only).”

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

15 Comments

We invite them and warn them to knock loud in case we are upstairs. ?

I answered one of these calls and immediately was suspicious. The guy said it was my fault and I was a horrible person for owing money and I was knowingly being fraudulent. I told him the IRS should mail me something and told him they never call. He said it was my fault I didn’t get the mail. I asked for the amount I owed and when he told me I laughed so hard. He said the police were going to be involved and how dare I laugh at him and he hung up on me! ?

How much did he say you owed?

Michele Feldman around $5600

Amy Bartlett Roysdon Nice round figure ?

Lol ? … I answered one phone call from them & I ask him “ Who the F**k is this … etc ????? & ??? they hung up ?

When they called ne he had the thickest Indian accent ever and said they would arrest me and send me to Washington dc i was like ok I’ll be waiting for them in my office

my daughter got a call and she doesn’t even have a job

Mike Malloy

I got one if those phone messages saying I was in deep trouble with the IRS, and to call back immediately.

I laughed at one of these guys and he started cussing me out so I let out the loudest, blood curdling scream that I could muster in his ear before hanging up. Please note: Do Not forget that your husband is up on a ladder, repairing the roof when doing this. I’ve never seen him move so fast and he was NOT happy. I had to promise to use an air horn from now on.

Good for you

It’s fun to mess with them ?

See you there

This IRS may not- but their Indian henchmen do ??