Sacramento – California Senator Scott Wilk (R-Antelope Valley) has introduced Senate Resolution 103, urging the Legislature to abandon the pursuit of a “pay-per-mile” tax on California motorists.

Sacramento – California Senator Scott Wilk (R-Antelope Valley) has introduced Senate Resolution 103, urging the Legislature to abandon the pursuit of a “pay-per-mile” tax on California motorists.

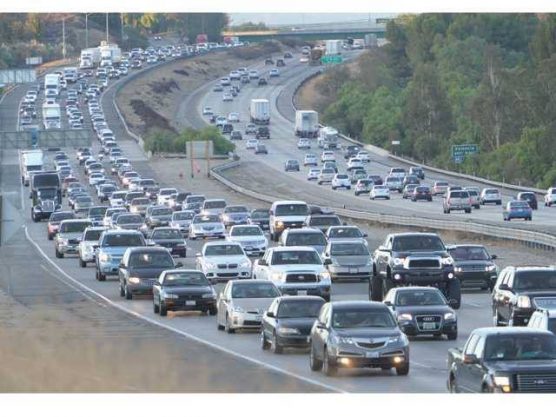

“Every workday over 200,000 commuters leave the Antelope and Victor valleys for work,” Wilk said. “Many of these super-commuters travel over a hundred miles a day. A pay-per-mile tax penalizes people who lack the resources to live in expensive urban centers and unfairly shifts the tax burden onto their shoulders. With the spike in home prices, this situation is only going to get worse.”

Between 2010 and 2015, the number of American super commuters, those who commute 90 minutes or more, has skyrocketed. California, with 635,024 super commuters, leads the nation in those traveling long distances to work.

The use of more fuel efficient, electric and hybrid vehicles has resulted in lower gas tax revenues for the state and transportation officials have been exploring ways to charge drivers based on miles driven.

Last year the California Legislature passed Senate Bill 1, a $52 billion dollar tax increase on Californians to fund construction and road projects. Among other things, SB 1 increased the gas tax rate by $0.12 per gallon, diesel fuel by $0.20 per gallon, raised vehicle registration fees and imposed an additional registration charge of $100 on certain zero-emission vehicles.

“Other states that have explored or enacted a pay-per-mile tax do not charge a fuel tax – certainly not one as high as California’s and it is doubtful the liberal majority in Sacramento would repeal the taxes and charges already imposed by Senate Bill 1 should a new system be adopted,” Wilk said. “Adding a tax per mile would drive businesses and Californians right out of the state.”

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS Sacramento – California Senator Scott Wilk (R-Antelope Valley) has introduced Senate Resolution 103, urging the Legislature to abandon the pursuit of a “pay-per-mile” tax on California motorists.

Sacramento – California Senator Scott Wilk (R-Antelope Valley) has introduced Senate Resolution 103, urging the Legislature to abandon the pursuit of a “pay-per-mile” tax on California motorists.

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

5 Comments

Fix the trains. Get people out of cars. Move jobs to the suburbs.

Thank you. This state is already bleeding us to death. It’s time Sacramento went on a tax diet.

That idea ^^^ only benefits those who are in a position to take the train, and who have jobs in the suburbs or those who cannot currently afford a vehicle so they pursue that life style. Do not worry about those who make their living driving on the roads. That per mile tax is just another very stupid way the California State Government continues to tax the crap out of all of its citizens. For the record, I am in favor of taking the train if it works for that person, its a great way to travel and for the most part safe, and productive…but this per mile tax is as lame as the Governor.

Scott, so what is your solution? If all vehicles are to be electric in the near future, how do you expect to build roads and maintain roads?

Please reply

If gas taxes were actually directed to repair the roads, this wouldn’t even be a topic right now. One more reason to leave this state.