|

|

|

|

|

|

The Santa Clarita Valley Sheriff's Station has issued the following traffic alerts: Due to heavy rains, the westbound right lane is closed on Soledad Canyon Road between Camp Plenty Road and Langside Avenue.

|

Fostering Youth Independence’s recent Charlie Brown Holiday party was attended by dozens of local foster youth and their volunteer Allies.

|

The National Weather Service as issued the following alerts for the Santa Clarita Valley. Flood Watch until Dec. 26, 4 p.m. PST, High Wind Warning until Dec. 25, 3 p.m. PST.

|

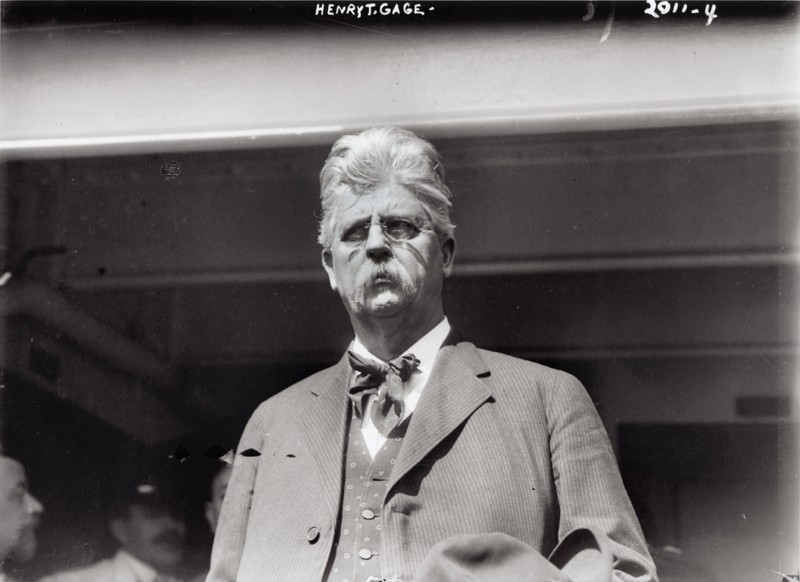

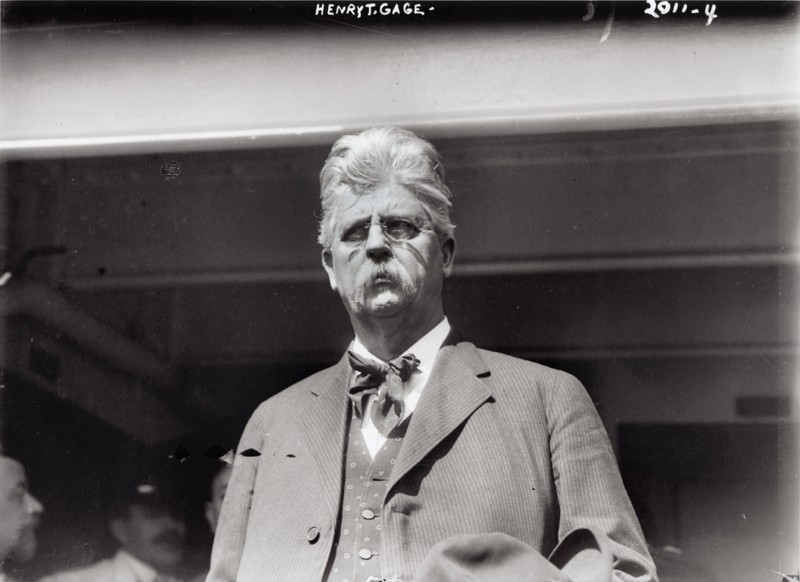

1852 - Acton gold mine owner & California Gov. Henry Tifft Gage born in New York [ story]

|

Los Angeles County Supervisor Kathryn Barger is urging residents to remain vigilant as a powerful storm system moves through Los Angeles County, bringing periods of heavy rain and rapidly changing conditions.

|

Thirteen suspects were arrested, and more than $800,000 in stolen merchandise was recovered following a coordinated, multi-agency operation targeting an organized retail theft network operating across Northern California.

|

The California State Transportation Agency today announced a new joint effort by two of its departments, the Department of Motor Vehicles and California Highway Patrol, to curb excessive speeding and prevent deadly crashes.

|

The city of Santa Clarita invites the community to heat up the holiday season at the Holiday Spice Salsa Edition on Saturday, Dec. 27, at the Canyon Country Community Center, located at 18410 Sierra Highway Santa Clarita, CA 91351.

|

1965 - Signal newspaper owner Scott Newhall shows up for a duel (of words) with rival Canyon Country newspaper publisher Art Evans, who no-shows and folds his paper soon after [ story]

|

As winter storms enter Los Angeles County, the Los Angeles County Department of Animal Care and Control urges pet owners to take necessary precautions in light of the significant storms expected to last for five days.

|

Brayden Miner scored 31 points and Rylan Starr had 24 as The Master's University men's basketball team crushed Bethesda University 145-59 The MacArthur Center.

|

From surprise Santa arrivals to stacks of gifts waiting for young hands, the Boys & Girls Club of Santa Clarita Valley delivered holiday cheer on a large scale this season, reaching hundreds of children and teens throughout the Santa Clarita Valley, including Clubhouses in Canyon Country, Newhall, Val Verde and Castaic.

|

Princess Cruises, headquartered in Santa Clarita, embraced a cherished maritime tradition in a uniquely festive way, celebrating a symbolic christening of its Rose Parade float with a ceremonial break of a bottle of Pantalones Organic Tequila.

|

The Golden Globes have ushered in awards season with the announcement of the 2026 nominees across 28 categories. Among this year’s contenders is Pixar’s "Elio," which earned a nomination for Best Motion Picture – Animated.

|

The National Weather Service has issued a "Hazardous Weather" warning for the Santa Clarita Valley and Southern California.

|

Detectives from the Los Angeles County Sheriff’s Department Missing Persons Unit are asking for the public’s help locating at-Risk missing person Drew Barrick Russell.

|

1997 - Five bodies found during grading of Northlake development in Castaic; determined to be Jenkins graveyard [ story]

|

Old Town Newhall Public Library will host "Spice Travels," Friday, Jan. 2, 9:15-9:30 a.m. at 24500 Main St., Santa Clarita, CA 91321.

|

|

|

The California Highway Patrol encourages the public to “brake” the habit of speeding this holiday season. The CHP will launch a Holiday Enforcement Period starting at 6:01 p.m. on Wednesday, Dec. 24, and ending at 11:59 p.m. on Thursday, Dec. 25.

|

Volunteers are needed to help clear brush and restore the tread from the existing lower Gates and Twister trails 8 a.m.-noon Saturday, Dec. 27.

|

Join InfluenceHER's "Redefining Happiness, a Candid Conversation for the Modern Woman," 4-6 p.m., Friday, Jan. 16 at the Venue Valencia.

|

The Santa Clarita Public Library system has announced that all library branches will close at 1 p.m. on Christmas Eve, Wednesday, Dec. 24, and remain closed on Christmas Day, Thursday, Dec. 25, in observance of Christmas.

|

Students pursuing an undergraduate degree in water resource-related fields are invited to apply for the 2026/27 ACWA Edward G. “Jerry” Gladbach Scholarship, offered by the Association of California Water Agencies in partnership with SCV Water. Applications are now being accepted through March 1, 2026.

|

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

0 Comments

You can be the first one to leave a comment.