The Los Angeles County Treasurer and Tax Collector reminds property owners that the second installment of the 2021-22 Annual Secured Property Taxes becomes delinquent if not received by 5 p.m. Pacific Time or United States Postal Service postmarked on or before Monday, April 11, 2022.

This is one day later than the traditional delinquency date of April 10, as this date falls on a Sunday in 2022. “To avoid late penalties, property owners should not wait until the last day to make payment; please pay early” said Treasurer and Tax Collector Keith Knox. “Property owners may find it difficult to reach us on the telephone. They may obtain answers to the great majority of their questions, including how to request a copy of a property tax bill, obtain the amount due on any property, or find the tax payment history for the past three fiscal tax years on the Los Angeles County Property Tax Portal at propertytax.lacounty.gov. Property owners may also call the toll-free Property Tax Information Line at 1 (888) 807-2111, where automated information is available 24 hours a day, 7 days a week.”

Payment Options

Partial Payments: We recommend you pay the total amount due. However, if you are unable to do so, we accept partial payments, which reduce the amount of penalties imposed.

Pay Online: To make payments online, go to propertytax.lacounty.gov and select “Pay Property Taxes Online.” You can make online payments 24 hours a day, 7 days a week up until 11:59 p.m. Pacific Time on the delinquency date.

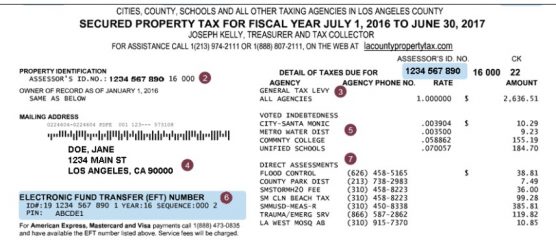

There is no cost to you for electronic check payments. The Annual Secured Property Tax Bill contains your Assessor’s Identification Number, the AIN and Personal Identification Number, your PIN, which you will need to complete the transaction. Each eCheck transaction is limited to $999,999.99.

You may view a step-by-step video on how to make an eCheck payment at Pay Property Taxes Online. The video is available in multiple languages.

When paying by eCheck, your bank account must be Automated Clearing House enabled, meaning the transaction can settle through the ACH Network. If your bank account has a debit block to prevent unauthorized organizations from debiting your account via ACH, you must notify your bank to authorize ACH debits from Los Angeles County with a debit filter with the Company Identification Number of 0 0 0 0 0 7 9 1 6 1.

Los Angeles County updated its Company Identification Number in September 2018, so you must update this Company Identification Number if you previously had a debit filter on your bank account.

You may also pay online by using major credit cards or debit cards. Each online credit/debit card transaction is limited to $99,999.99, including a cost, currently 2.22 percent of the transaction amount.

Pay Over the Telephone: We accept major credit card and debit card payments over the telephone. To pay by telephone, call toll-free 1(888) 473-0835. The Annual Secured Property Tax Bill contains your Assessor’s Identification Number, Year and Sequence, which you will need to complete the transaction. Each credit/debit card transaction is limited to $99,999.99, including a cost, currently 2.22 percent of the transaction amount.

By Mail: Use the envelope enclosed in your Annual Secured Property Tax Bill and include the second installment payment stub from the tax bill. Do not attach staples, clips, tape, or correspondence. You must mail property tax payments to the Los Angeles County Treasurer and Tax Collector, Post Office Box 54018, Los Angeles, CA 90054-0018.

Do not mail your payments to any other address. Property tax payments must be received or USPS postmarked by the delinquency date to avoid penalties. If we receive your payment after the delinquency date, with no postmark, the payment is late and we will impose penalties, in accordance with State law. We caution taxpayers who send their payments by mail that the USPS only postmarks certain mail depending on the type of postage used and may not postmark mail on the same day taxpayers deposit envelopes.

To assist taxpayers in understanding how to avoid penalties that could result from postmark issues, we have compiled important information on how to “Avoid Penalties by Understanding Postmarks.” Visit our website at Understanding Postmarks.

You may use an Internal Revenue Service designated delivery service such as DHL Express, FedEx, or UPS to mail your payment, properly addressed with the required fee prepaid, delivery of which shall not be later than 5 p.m. Pacific Time on the next business day after the effective delinquency date Monday, April 11, 2022. Mail payments to Los Angeles County Tax Collector, Kenneth Hahn Hall of Administration, 225 North Hill Street, Room 137, Los Angeles, CA 90012.

Do not mail your payments to any other address. The remittance shall be deemed received on the date shown on the packing slip or air bill attached to the outside of the envelope or package containing the remittance.

Pay in Person: We accept cash, check, money order, cashier’s check, and major credit cards and debit cards at 225 North Hill Street, First Floor Lobby, Los Angeles, CA 90012, between 8 a.m. and 5 p.m. Pacific Time, Monday through Friday, excluding Los Angeles County holidays. Each credit/debit card transaction is limited to $75,000 including a cost, currently 2.22 percent of the transaction amount.

Online Bankding or Bill Payment Services: We DO NOT recommend using these services to pay property taxes. The USPS does not postmark the envelopes these firms use to mail us the payment. In the absence of a postmark, we determine penalties based exclusively on the date we receive payment.

Email Notification Service

Property owners can subscribe to receive property tax related emails from the Treasurer and Tax Collector regarding special notices and upcoming events, such as annual property tax deadline reminders, office location updates and other news. To subscribe, taxpayers may visit Email Notification Service.

Like this:

Like Loading...

Related

Tweet This

Tweet This Facebook

Facebook Digg This

Digg This Bookmark

Bookmark Stumble

Stumble RSS

RSS

REAL NAMES ONLY: All posters must use their real individual or business name. This applies equally to Twitter account holders who use a nickname.

2 Comments

There are so many things due let’s start from the beginning

i PAID ALL PROPERTY TAXES THRU wELLS fARGO BILL PAY

ALL PAYMENTS CLEARED TAX COLLECTOR BANK ACCOUNT.

i PAID WELL AHEAD OF DEADLINES. wELLS FARGO IS SENDING PROOF MY PAYMENTS MARKED WITH apn# CLEARED LA COUNTY BANK ACCOUNT. COLLECTOR CLAIMS

I OWE EXTA 2091.51 DOLLARS BY 6-30-23. hOW DO i HANDLE THIS PROBLEM? 5-7 BUSINESS DAYS BEFORE I RECEIVE PYMT PROOF BY MAIL FROM WELLS FARGO BANK.

tHANKS

MICHAEL 7512-022-010